Go and Stop Signals

Keebler’s deluxe chocolate chip cookies are Jennifer’s favorite brand of cookies. They are neither too chewy nor too crumbly. And they have just the right amount of chocolate chips in them to make them irresistible. So on a Saturday evening in 2004, during a weekly visit to the grocery store when she found that Keebler’s deluxe chocolate chip cookies were on sale—two regular packs for $5—she was instinctively inclined to add two packs to her shopping cart.

But something held her back. Each regular pack contained 14.2 oz of cookies. Is it wise to have two large packs of the sugar-and-carbohydrates- filled vice in her pantry? She wondered. Two large packs of chocolate chip cookies would surely put her self-control to test. She knew that if she had a pack of cookies sitting around, she would be tempted to grab one whenever she is in the kitchen. The temptation would be particularly difficult to overcome when she is hungry or tired. As she was mulling over this dilemma, her eyes fell on the 100-calorie packs of the same brand of cookies on the adjacent shelf. Luckily for her, the 100-calorie packs were also on sale that week—two 100-calorie packs for $5. Instead of two regular packs, she could buy two 100-calorie packs for the same amount of money. Each 100-calorie pack contained 4.44 oz of cookies and they were divided into six single-serve pouches. This certainly is a more justifiable way to indulge my cravings, thought Jennifer as she walked to the checkout counter with the two 100-calorie packs in her shopping cart.

Jennifer is one of the millions of cookie lovers who have switched from regular packs to 100-calorie packs. The concept of the 100-calorie pack— which offers about one-third less product for the same price—was introduced in 2004 by Nabisco and has been a remarkable success in the snack food industry. In 2004, there were about five brands of 100-calorie packs available on the market. Within a year this number was closer to 50 with several other major food brands launching their own version of 100-calorie packs. In 2014 practically every major food brand has a 100-calorie version of their product available in the market. Pepperidge Farm started selling 100-calorie variations of Goldfish and other cookies.

Why People (Don’t) Buy: The Go and Stop Signals, Amitav Chakravarti, Manoj Thomas

Amazon Review Sentiment Analysis

Today we are performing some related experiments to see if any outcomes stand out. I don’t have access to some important data that one would need to draw firmer conclusions, but I can still sketch the outlines and explain how I decided to explore this subject.

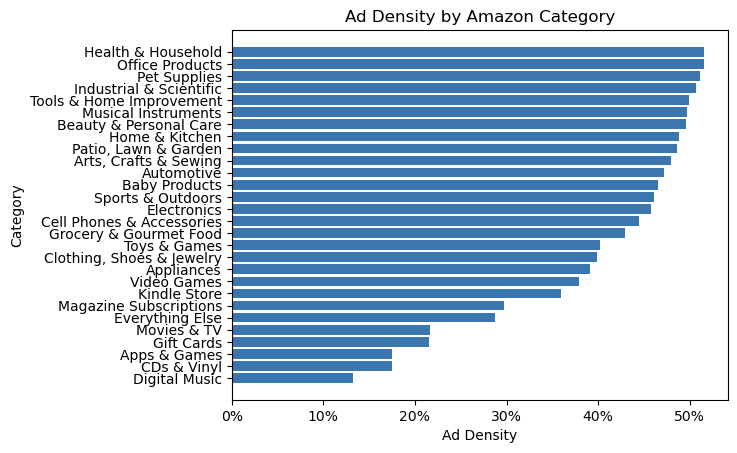

There is a post published by the people at momentum commerce that describes the ad density on Amazon per subcategory:

Below, we examine the Ad Density for the top 10 listings across all top-level Amazon categories for the week of July 17 to July 23, 2021. We can see that certain categories, such as “Health & Household”, have an Ad Density of over 50%, meaning that on average over half of the top products that associate with search terms are sponsored. The “Toys & Games” category is less ad dense than “Health & Household”, but still returns around 40% of sponsored listings within the most frequently searched terms.

While it’s useful for a brand to know the competitiveness of their overall category, the actionable insights become more prevalent as we dive further into the Amazon taxonomy as it’s likely a brand is mostly concerned with a smaller portion of the overall category market.

Amazon Advertising up 87% YoY But Ad Rates Still Vary by Category, by Jeff Paadre

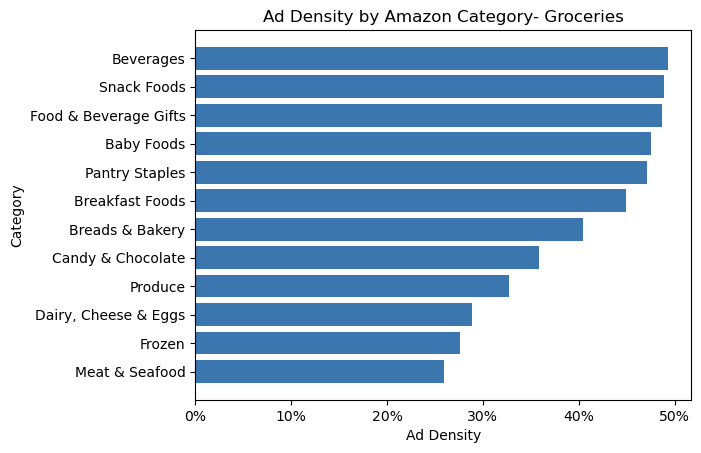

Intuitively, it makes sense that we would want to find some other way of organizing products by ad density. Jeff goes on to break down the Groceries subcategory further:

As seen above, Ad Density at the subcategory level begins to vary more. Certain product types such as “Snack Foods” and “Pantry Staples” have higher ad densities, signaling that results in these fields are more driven by ad spend than “Produce” products. By contrast, categories like “Dairy, Cheese & Eggs” or “Meat and Seafood” show sponsored listings less than 30% of the time.

Amazon Advertising up 87% YoY But Ad Rates Still Vary by Category, by Jeff Paadre

For now, I’m just going to outline my preliminary thoughts, but the general hypothesis is this:

Product categories with high ad density on Amazon that do not encourage impulse buying, like commodity goods, have more ambiguous reviews than commodities.

A sentiment analysis using a model trained on huggingface’s Amazon review dataset would be used.

But this is just prelimiary research!

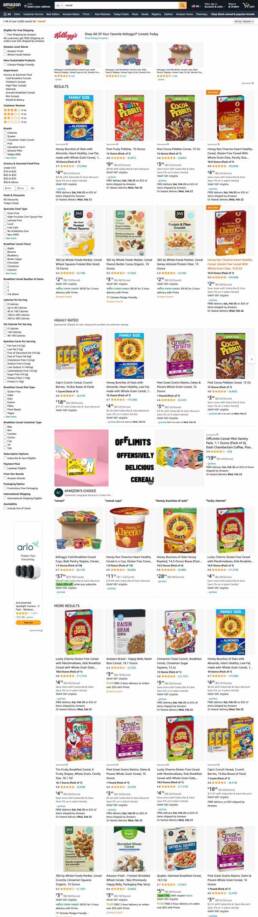

I tested a few search terms on the desktop display version of Amazon to see how my expectations mapped to reality: my expectation was that search results for cereal, a highly marketed product category, would have more ads populating search results that a search for a commodity good.